Excise tax calculator

One tax in particular that affects the consumption of specific goods is the excise tax a very specific often very targeted tax that you pay sometimes without realizing it. Enter Your Home Value to Calculate REET Tax.

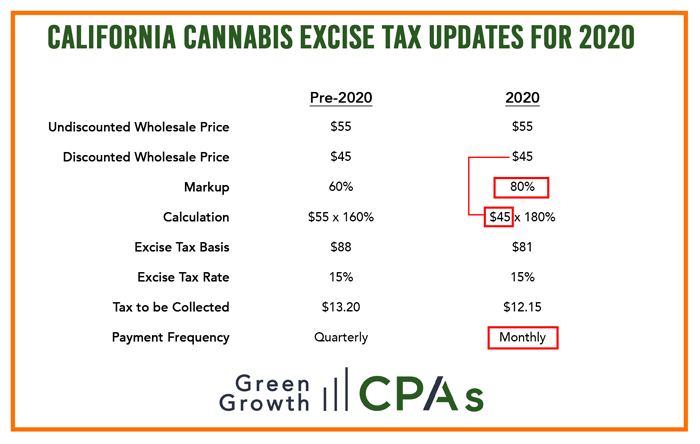

Cannabis Excise Tax Calculation Updates For 2020 Greengrowth Cpas

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

. Municipality tax of 5 included in estimate. This is the 24th-highest cigarette tax in the US. Natural gas liquefied hydrogen propane P-Series fuel liquid fuel derived from coal through the Fischer-Tropsch process and.

Your household income location filing status and number of personal exemptions. After the cars first year for cars with a list price below 40000 the road tax costs are change. Find out how this could impact your plans for selling your home.

The browser you are using is not supported for the DC DMV Online Services. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arkansas local counties cities and special taxation districts. A tax incentive is available for alternative fuel that is sold for use or used as a fuel to operate a motor vehicle.

Contractors Excise Tax Bid Factor Calculator. Virginia has a 43 statewide sales tax rate but also has 270 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1327 on top of the state tax. You can also input a custom scenario.

HST tax calculation or the Harmonized Sales Tax calculator of 2022 including GST Canadian government and provincial sales tax PST for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador. This tax is not paid directly by. Statement of Exportation of Motor Fuel By Purchaser.

This means that depending on your location within Wisconsin the total tax you pay can be significantly higher than the 5 state sales tax. There are many forms of taxation in the United States some collected by the federal government and others by local governments and States. Effective January 1st 2020 Washington state will begin calculating real estate excise taxes REET based on a tier system.

Excise Taxation and Narcotics Control Department Government of Sindh Introduction. Unlike a sales tax an excise tax is usually a fixed amount not a percentage of the purchase price and excise taxes are only collected on the sale of specific taxable products rather then on all sales made within the state. The Department has been entrusted with two functions ie.

A tax credit in the amount of 050 per gallon is available for the following alternative fuels. The supported browsers are Google Chrome Mozilla Firefox Microsoft Edge and Apple Safari. Form number Instructions Form title.

This means that depending on your location within Virginia the total tax you pay can be significantly higher than the 43 state sales tax. Enter your vehicle cost. This allows you to collect the full amount of excise tax due.

- NO COMMA For new vehicles this will be the amount on the dealers sticker not the amount you paid. Wisconsin has a 5 statewide sales tax rate but also has 99 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0481 on top of the state tax. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Because contractors excise tax is owed on your gross receipts which include any taxes collected from the customer a bid factor of 2041 may be used to calculate the excise tax when preparing a bid or bill. Fuel Tax Exempt Purchase Certificate for an Agent of a New York Governmental Entity. For all cars with a CO2 rating of zero the tax bill is zero and for all cars above 255gkm youll pay an additional 135 for an alternatively-fuelled car and an additional 145 for petrol and diesel-powered cars.

Tax collection and Narcotics suppression. Available by calling 518 485-2889. New Hampshires excise tax on cigarettes totals 178 per pack of 20.

Petroleum business and fuel excise tax exemption documents. The calculator allows you to compare how different sample taxpayers fare under different proposals. Weve created a tax calculator that helps demonstrate how the Tax Cuts and Jobs Act TCJA and other major tax reform proposals could affect taxpayers in different scenarios.

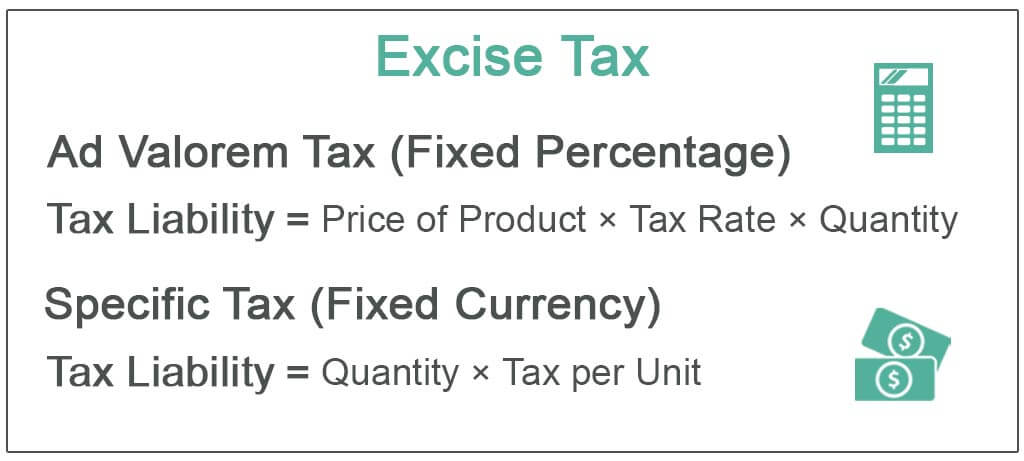

Excise tax differs from sales tax in two fundamental. The Excise Taxation Department is the main revenue collecting agency of the Government of Sindh which plays a paramount role in resource mobilization.

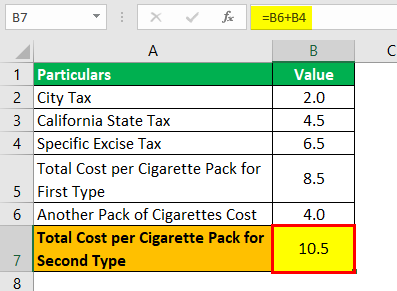

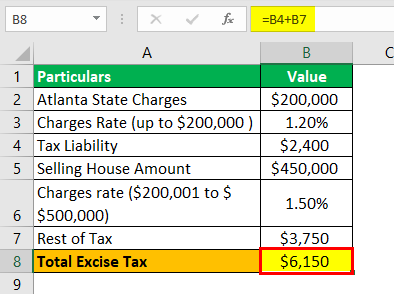

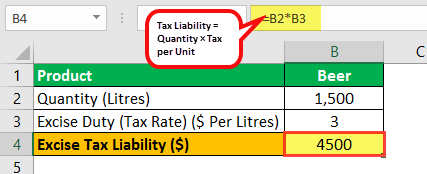

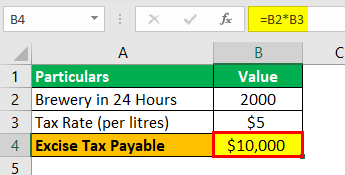

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

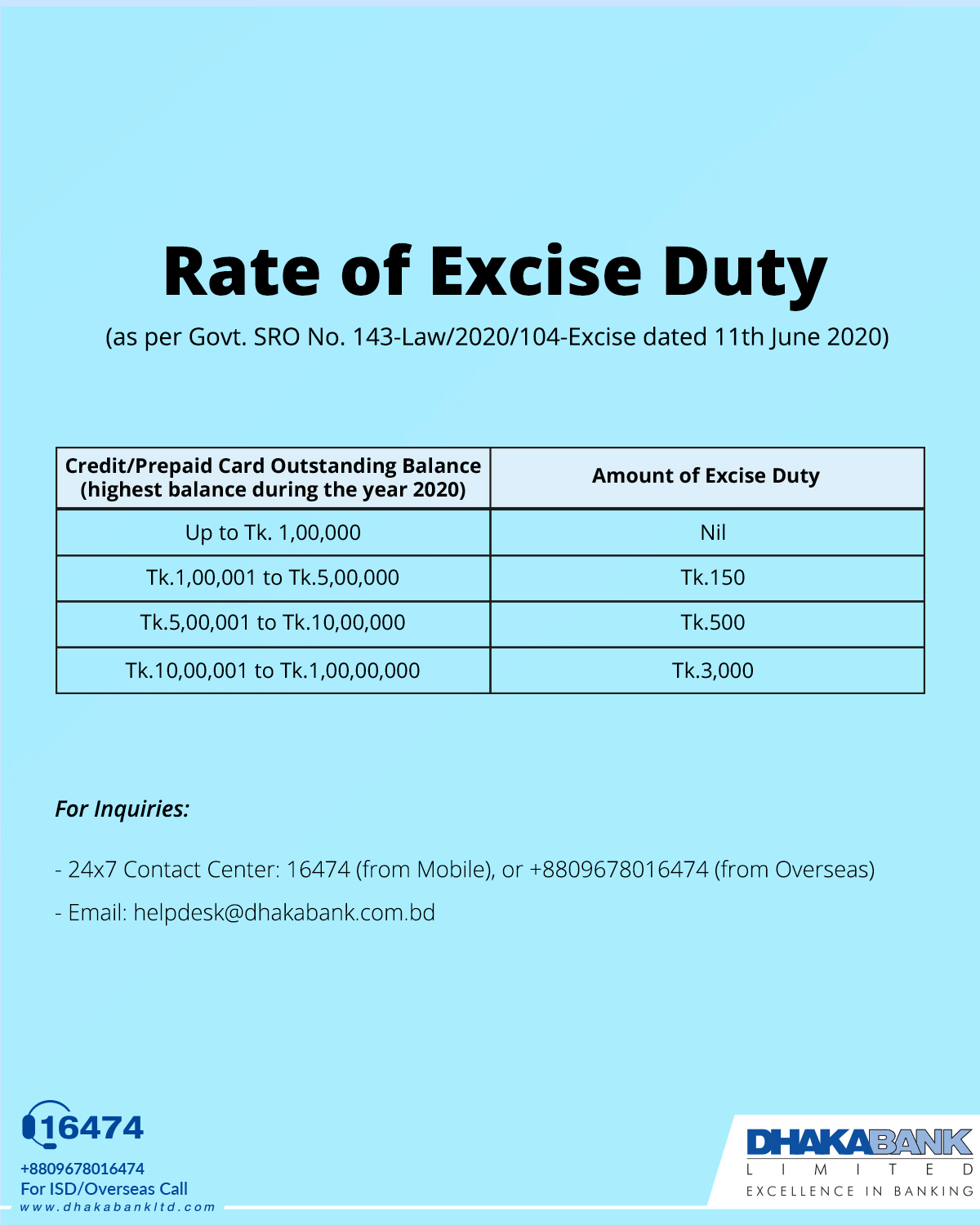

Rate Of Excise Duty Dhaka Bank Excellence In Banking

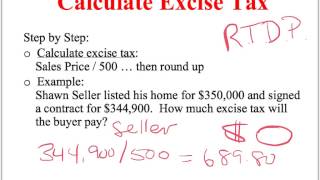

Calculating Excise Tax Help With Closing Statments Youtube

How To Calculate Cannabis Taxes At Your Dispensary

Excise Tax Definition Types Calculation Examples

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

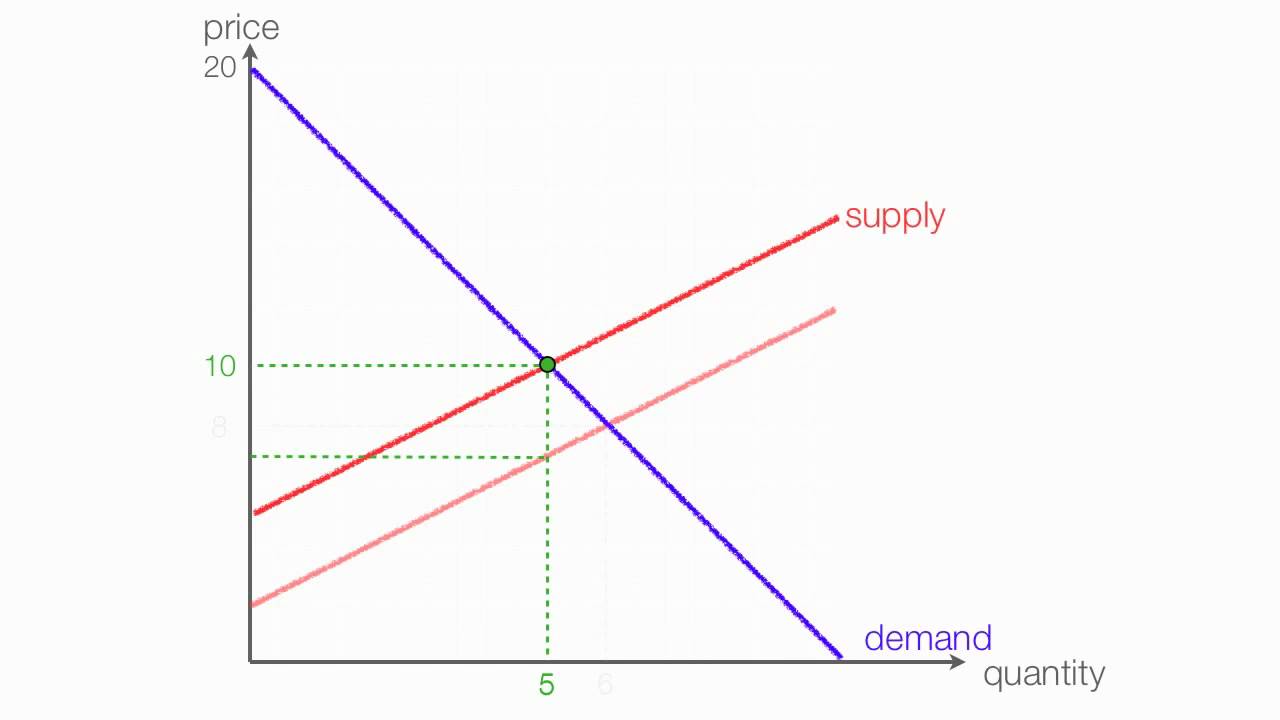

Microeconomics Excise Tax Effect On Equilibrium Youtube

How To Calculate Excise Tax And The Impact On Consumer And Producer Surplus Youtube

Excise Tax What It Is How It S Calculated

Excise Tax Definition Types Calculation Examples

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Excess Burden Of An Excise Tax Demand Version Youtube

Use This Free Calculator To Estimate Canadian Cannabis Excise Tax

Excise Tax Definition Types Calculation Examples

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Calculating Excise Tax Help With Closing Statments Youtube