45+ mortgage commitment letter vs clear to close

A mortgage commitment letter is just the last step in a longer process. Legally lenders must send borrowers a Closing Disclosure at least 3.

Internship Report Docx

However this number can fluctuate.

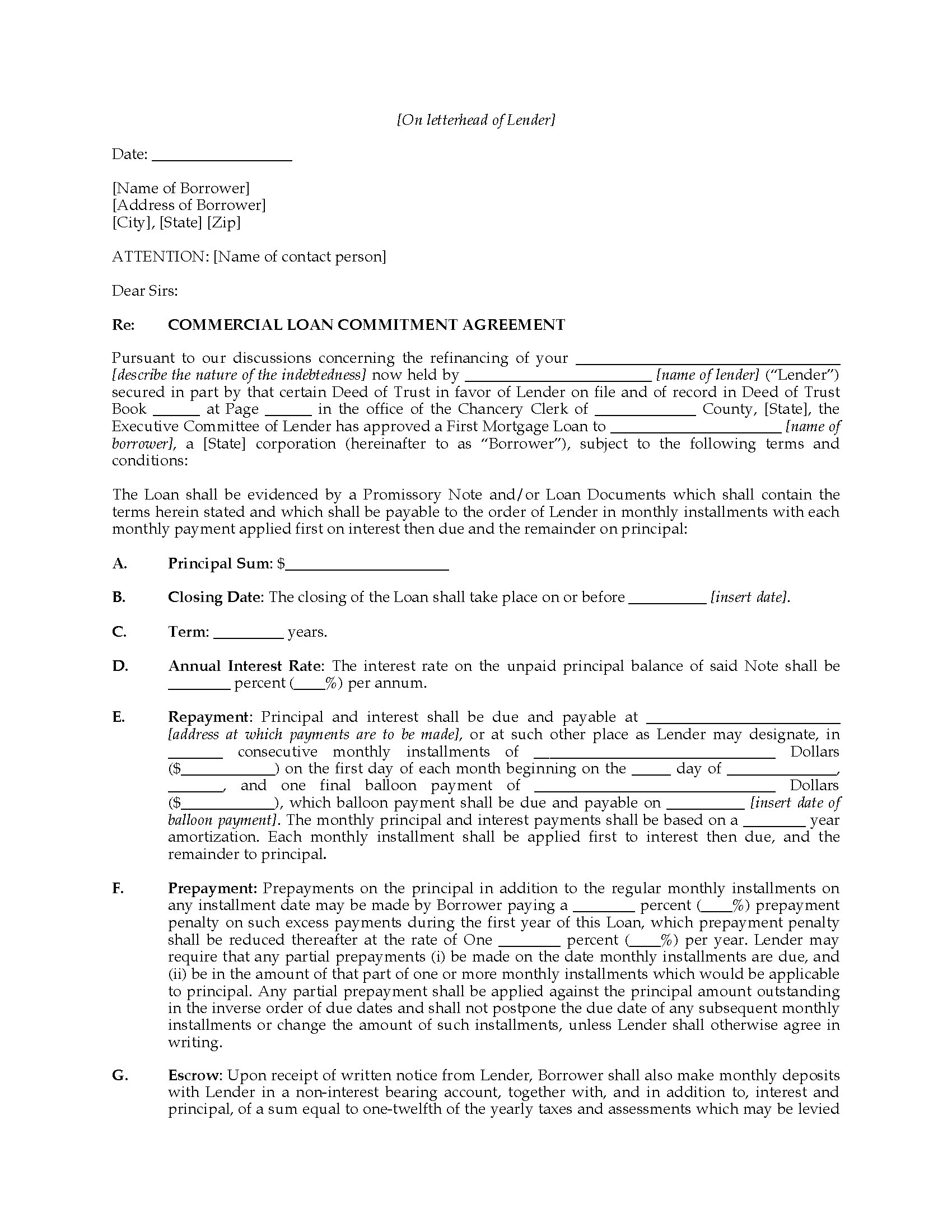

. Underwriting conditions are found in the commitment letter the. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. VA Loan Expertise and Personal Service.

This document specifies that youre approved to borrow a specific amount of funds given. Web The average time to close a home is 47 days from the day an application for a loan is submitted to the final signed documents. Contact a Loan Specialist.

Web According to Ellie Maes Origination Insight Report for 2019 the average closing takes about 47 days from start to finish. Web Heres a breakdown of the two. Web A mortgage commitment letter is a document your lender provides that states youre officially approved for a mortgage loan and details some of the terms of the loan.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Conditional mortgage commitment letter. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

This is issued when all mortgage conditions are met and the file is ready to be sent to the closing attorney. Web A final commitment shows buyers and sellers that the former are clear to close. Web A clear to close is when everyone can breathe easy.

The bank has underwritten the loan and agrees to lend the money assuming that all of the conditions outlined in the loan commitment letter are properly. Web A mortgage commitment letter is a document that lets everyone in the real estate transaction real estate agents sellers etc know that the lender is prepared to. Web This letter usually indicates A the type of loan being used B the amount of money being borrowed C the length or term of the repayment period and D the interest rate.

Get Your Quote Today. This is the amount of time it takes from loan. The letter signals to the seller that.

Web Youll generally hit the clear to close milestone 3 days before you can close on the home. Web A mortgage commitment letter conditional or final is a step close to finalizing a mortgage but short of clear to close. Web The average time to close a mortgage ranges from 45 to 60 days but many will close in less about 30 days.

This of course depends on a few. Web Being clear to close requires you to meet underwriting funding and quality control conditions.

What Is Clear To Close And How Much Longer Until Closing Upnest

If Your Mortgage Commitment Letter Expires Before Closing Date

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Usa Commercial Loan Commitment Letter Legal Forms And Business Templates Megadox Com

Mortgage Commitment Letter Nailing Down Your Financing Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Report By The Director General On The Execution Of The Programme Adopted By The General Conference

Reviews Lumina Solar

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Pdf The Equality Implications Of Being A Migrant In Britain Sue Lukes Academia Edu

What Is A Mortgage Commitment Letter Supermoney

The Functioning And Effects Of The Tanzanian Literacy Programme

Tm218178d2 6kimg047 Jpg

Get Closer To Homeownership With A Mortgage Commitment Letter Mfm Bankers

Pdf Nathan Gyesi Ocran 216012309 Final Work Nathan Ocran Academia Edu

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

What Is A Mortgage Commitment Letter

Mortgage Commitment Letters Key Things You Need To Know My Finance Instructor