28+ nebraska payroll calculator

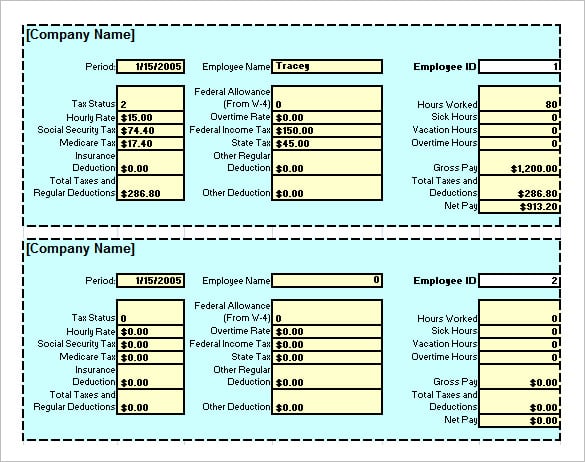

Web Nebraska Paycheck and Payroll Calculator Free Paycheck Calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web How to calculate annual income.

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

Once calculate paycheck has been clicked the result is presented.

. Is the Nebraska paycheck calculator accurate. Web Nebraska Hourly Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Nebraska.

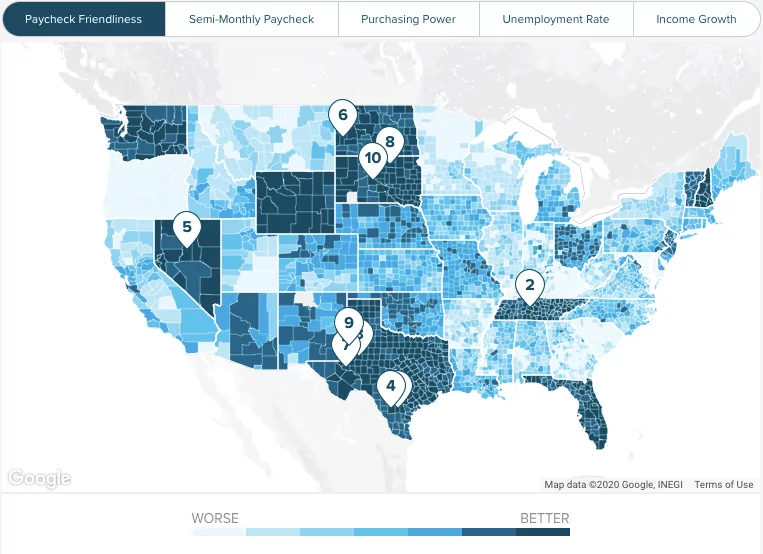

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Nebraska has a progressive income tax system with four brackets that vary based on income level and filing status.

Web People from Nebraska can use this calculator to figure out their take-home salary. Web Nebraska Paycheck Calculator Use ADPs Nebraska Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web 2022 Payroll Processing Schedule - Monthly - PDF.

These calculators should not be relied upon for accuracy such as to calculate exact taxes payroll or other financial data. Paycheck Calculator is a great payroll calculation tool that can be used to compare net pay amounts after payroll taxes in different states. Once done the result will be your estimated take-home pay.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Employers can use it to calculate net pay and figure out how much to withhold so you can. 2021 Payroll Processing Schedule - Monthly - PDF.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Web 2023 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

Web How do I use the Nebraska paycheck calculator. Launch Free Calculator OR See Nebraska tax rates Federal Payroll Taxes. See payroll calculation FAQs below.

Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and state payroll withholding such as State Disability Insurance State Unemployment Insurance and others. If you make 70000 a year living in Nebraska you will be taxed 11501. Calculating your Nebraska state income tax is similar to the steps we listed on our Federal paycheck calculator.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Switch to Nebraska hourly calculator. Figure out your filing status.

Web Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Simply follow the pre-filled calculator for Nebraska and identify your withholdings allowances and filing status. Overview of Nebraska Taxes.

All you have to do is input wage and W-4 information for each employee into the calculator and it will do the rest. Web Nebraska Income Tax Calculator 2022-2023. 2020 Payroll Processing Schedule - Biweekly - PDF.

2019 Payroll Processing Schedule - Biweekly - PDF. Web The calculator can figure out all of the federal and Nebraska state payroll taxes for you and your employees. Switch to salary Hourly Employee.

2019 Payroll Processing Schedule. Work out your adjusted gross income Net income Adjustments Adjusted gross income. 2021 Payroll Processing Schedule - Biweekly - PDF.

Your average tax rate is 1167 and your marginal tax rate is 22. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Nebraska. 2020 Payroll Processing Schedule - Monthly - PDF.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Web The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Nebraska State Income Tax Rates and Thresholds in 2023. Well do the math for youall you need to do is enter the applicable information on salary federal and.

Web So the tax year 2022 will start from October 01 2021 to September 30 2022. Web Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska paycheck calculator. Your name check date marital status and federal and state withholding allowances are the only pieces of information that are necessary.

10785 Rockwood Dr Kirtland Oh 44094 Realtor Com

![]()

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

Metropolitan Community College Women S History Month

8 Salary Paycheck Calculator Doc Excel Pdf

How Much Sand Is Required In 1 M3 By Using An M25 Quora

Independent Houses Near Asura Garage 28 Houses For Sale Near Asura Garage

Faith Independent Pioneer Review

Tip Tax Calculator Primepay

Christophe Pochari Page 2 Advanced Energy Systems

Is It Worth Leaving 38 Lac Per Annum In India And Accepting 300 000 Pln In Warsaw Poland Quora

Nebraska Salary Calculator 2023 Icalculator

Calameo Delta County Independent Issue 41 Oct 13 2010

14 Sample Health Assessment Reports In Pdf Ms Word

1260 Conner Rd Lake Lure Nc 28746 Realtor Com

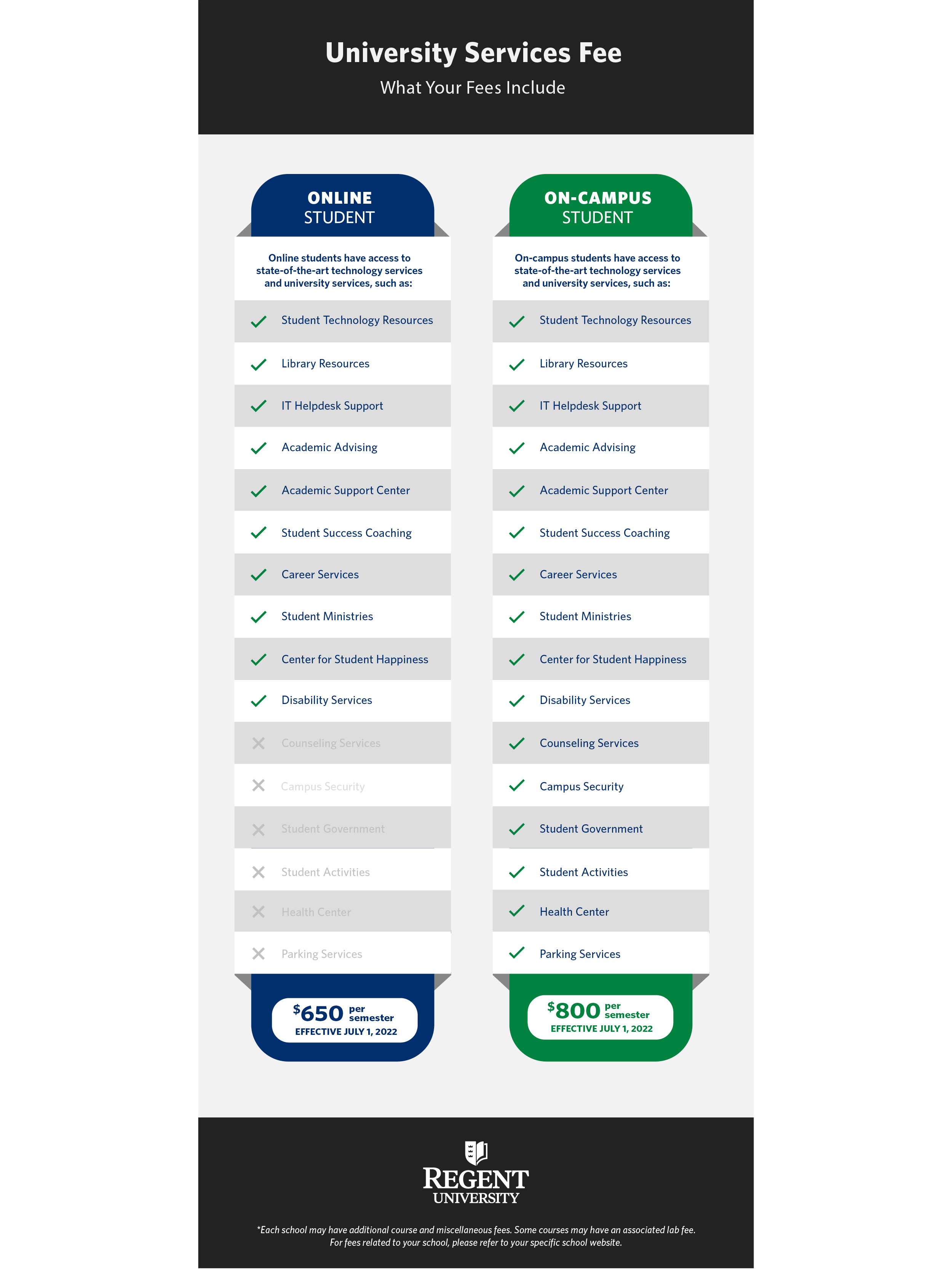

Scholarships For On Campus Undergraduate Students Regent University

The Maximum 401k Contribution Limit Financial Samurai

Nebraska Salary Paycheck Calculator Gusto